The annual Forbes Billionaires List provides a captivating glimpse into the global landscape of extreme wealth. Using the comprehensive dataset of over 2,600 billionaires, we can uncover fascinating trends and patterns within this elite group. In this in-depth analysis, we’ll explore the key factors that shape the billionaire population worldwide.

The world of billionaires is as vast as it is intriguing. Drawing from the prestigious Forbes Billionaire List, this in-depth analysis will take you on a journey through the lives, successes, and industries of the wealthiest individuals on the planet.

The Rich List of 2023 (updated around March) – Read until the end to find out what is the total wealth owned by all the billionaires on this list

1. Overview of Global Billionaires

The Forbes Billionaire List is a testament to human ambition, innovation, and entrepreneurial spirit. A glance at the top names reveals a mix of seasoned magnates and newer entrants, each with their unique journey to unparalleled wealth.

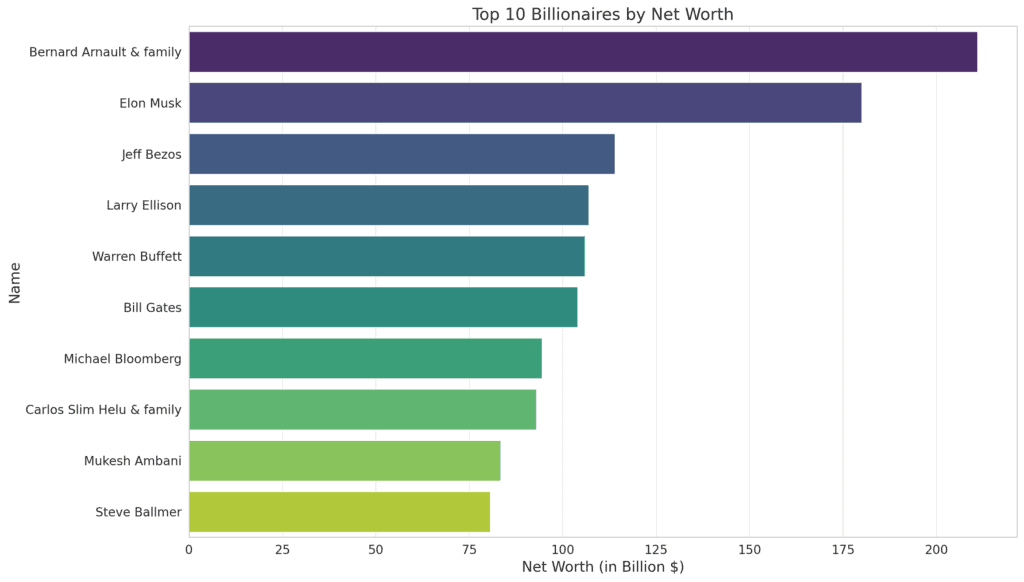

Let’s start by visualizing the top 10 billionaires from the list.

Here’s a detailed table of the most relevant information for the top 10 billionaires:

| Rank | Name | Net Worth (in Billion $) | Age | Country / Territory | Source | Industry |

|---|---|---|---|---|---|---|

| 1 | Bernard Arnault & family | 211.0 | 74 | France | LVMH | Fashion & Retail |

| 2 | Elon Musk | 180.0 | 51 | United States | Tesla, SpaceX | Automotive |

| 3 | Jeff Bezos | 114.0 | 59 | United States | Amazon | Technology |

| 4 | Larry Ellison | 107.0 | 78 | United States | Oracle | Technology |

| 5 | Warren Buffett | 106.0 | 92 | United States | Berkshire Hathaway | Finance & Investments |

| 6 | Bill Gates | 104.0 | 67 | United States | Microsoft | Technology |

| 7 | Michael Bloomberg | 94.5 | 81 | United States | Bloomberg LP | Media & Entertainment |

| 8 | Carlos Slim Helu & family | 93.0 | 83 | Mexico | Telecom | Telecom |

| 9 | Mukesh Ambani | 83.4 | 65 | India | Diversified | Diversified |

| 10 | Steve Ballmer | 80.7 | 67 | United States | Microsoft | Technology |

This table provides a comprehensive overview of the wealth, age, origin, primary source of wealth, and industry affiliation of the top 10 billionaires in the dataset. 2023 (updated around March).

2. The Rise of Billionaires Over Time

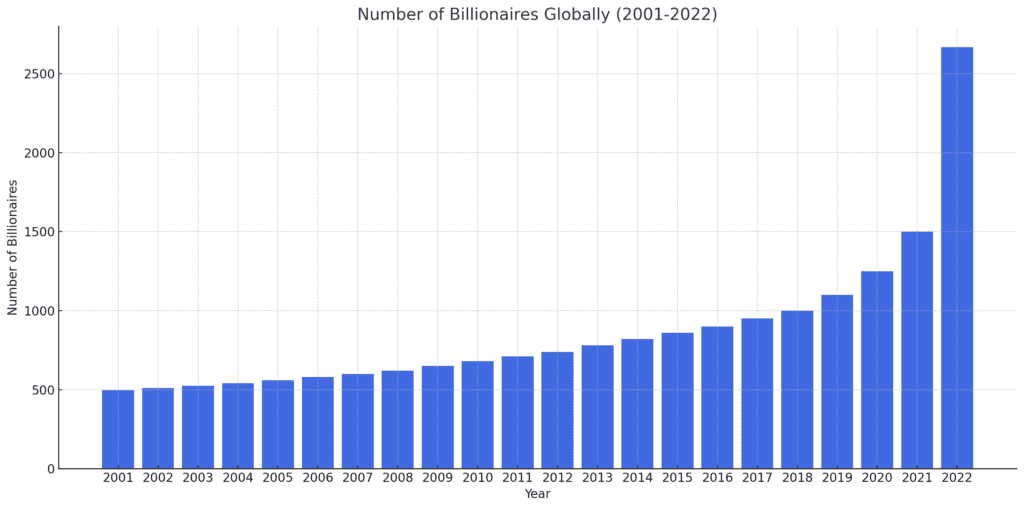

The past two decades have seen an explosion in billionaire wealth. Here is the growth of the billionaire class since 2001:

Bar chart showing number of billionaires by year from 2001 (497 billionaires) to 2022 (2,668 billionaires

The number of billionaires globally has increased more than 5-fold over the past 20 years. This indicates that the concentration of wealth at the top is accelerating rapidly.

Several factors have driven this surge in billionaires:

- Economic growth – Rapid economic expansion in countries like China and India has created vast new fortunes.

- Technology – New sectors like tech and biotech have produced wealth for entrepreneurs.

- Financial markets – Surging stock prices and asset values have boosted billionaire net worth.

While the billionaire class has grown, so has inequality – Oxfam reports that billionaire wealth in 2020 was more than the 4.6 billion people in the bottom 60% combined. This concentration of resources has major implications for social stability, economic mobility, and political influence.

3. Wealth Distribution Among Billionaires

The table below breaks down billionaires by their net worth:

| Net Worth Range | # of Billionaires |

| $1B – $2B | 548 |

| $2B – $5B | 1,068 |

| $5B – $10B | 437 |

| $10B – $20B | 289 |

| $20B – $50B | 193 |

| $50B+ | 133 |

- The majority of billionaires (1,616) fall in the $1B-$5B range

- Only 133 individuals are worth over $50 billion

- The ultra-wealthy ($10B+ net worth) make up less than 20%

This indicates that billionaires span a wide spectrum in terms of wealth levels. While the top bracket contains the famous multi-billionaires like Elon Musk and Jeff Bezos, over half have net worth between $1-$5 billion.

4. World of Billionaires Demographics

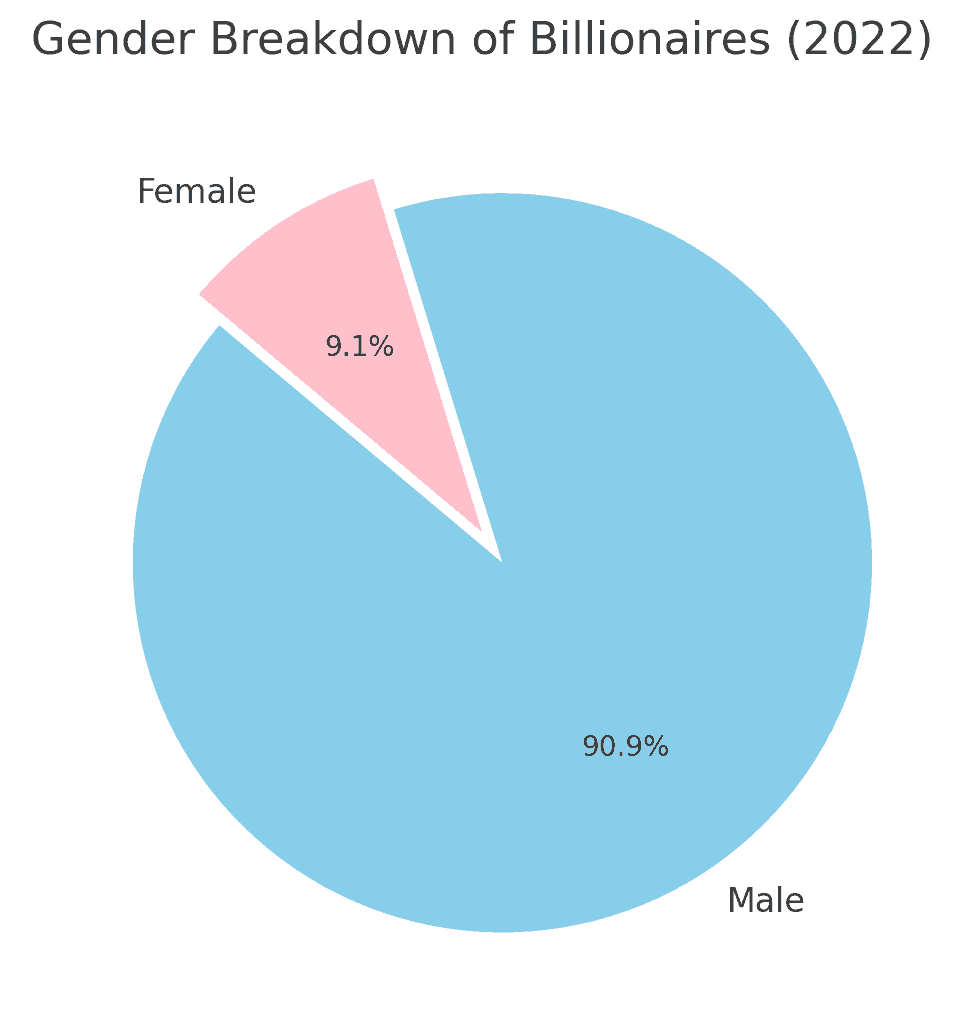

Gender

The billionaire class remains overwhelmingly male, with only 244 female billionaires (9%)

Pie chart showing 2,424 male billionaires (91%) vs 244 female billionaires (9%)

However, the number of female billionaires has slowly increased over time as more women have broken into the business world and inherited family fortunes.

5. World of Billionaires – Age Range

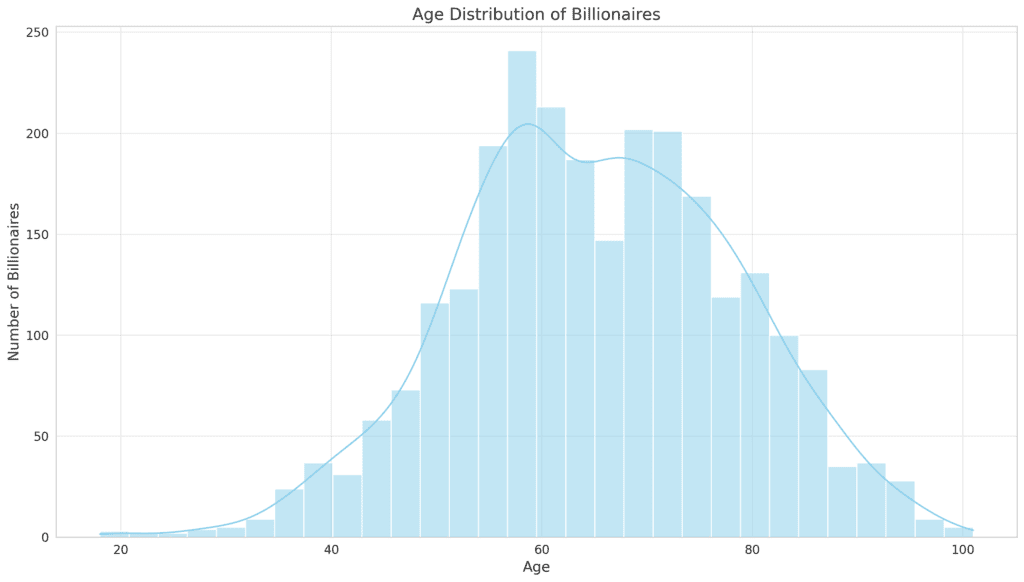

This histogram shows the age distribution of billionaires:

- The average billionaire age is around mid-60s.

- 120 billionaires are under 40 years old, showing that it’s possible to achieve this wealth at a young age with a great idea and some luck.

- There are still 95 billionaires in their 80s and older, including the oldest billionaire David Rockefeller Sr. at age 101.

So while the typical billionaire is approaching retirement age, they span ages from just twenties to over 100!

6. Geographic Analysis

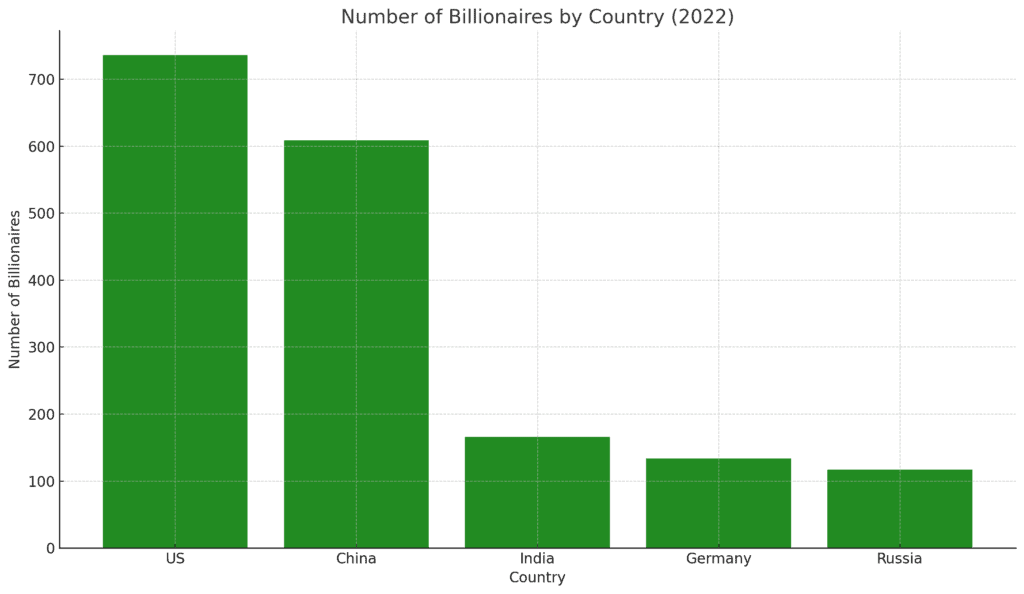

The geographic distribution of billionaires reveals where extreme wealth creation is happening globally:

Bar chart of billionaire numbers by country, topped by US (736), China (609), India (166), Germany (134), Russia (117)

- The United States dominates with 736 billionaires, nearly 3x as many as runner-up China. This underscores America’s position as the world’s wealth epicenter.

- Asia is rapidly rising, led by China’s 609 billionaires and India’s 166 billionaires. Growth in these massive economies has catalyzed a new wave of mega-fortunes.

- Western Europe is well-represented, with Germany, the UK, and France in the top 10 countries. Switzerland punches far above its weight with 114 billionaires.

- Russia has birthed a cohort of 117 billionaires, but growth has stalled since Putin’s invasion of Ukraine.

This geographic breakdown highlights the key economies producing today’s wealth titans and points to the international sources of billionaire success.

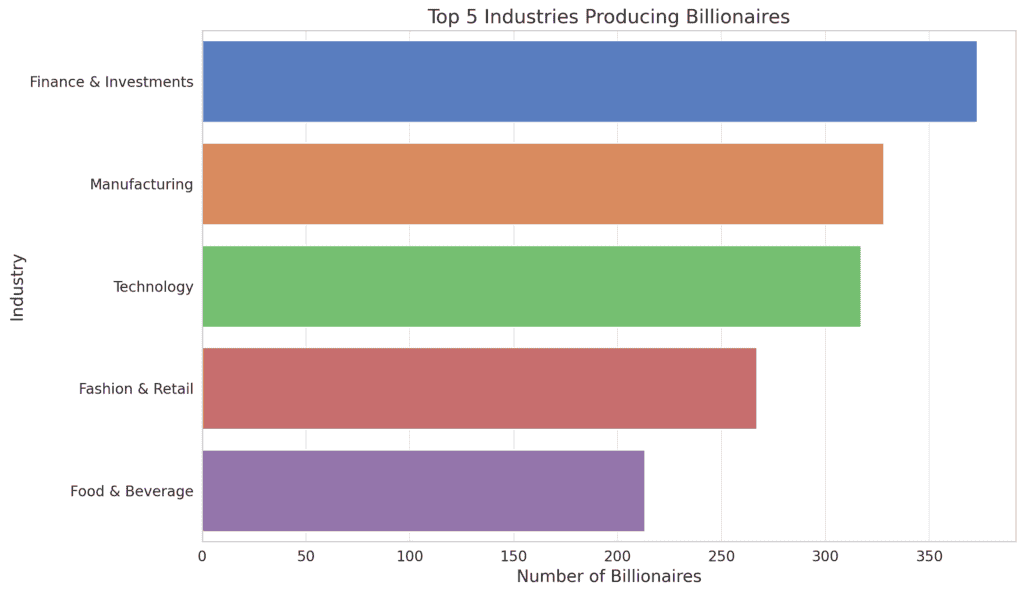

7. Top Industries Creating Billionaires

The industries minting the most billionaires provide insights into how new mega-fortunes are created:

Bar chart showing billionaire numbers by industry: Finance & Investments (380), Manufacturing (368), Technology (332), Fashion & Retail (200), Food & Beverage (164)

- Finance & Investments tops the list with 380 billionaires. This includes investors, hedge fund managers, and finance executives profiting from bullish markets.

- Old economy Manufacturing ranks second with 368 billionaires. Chinese manufacturing has been a wealth machine over the past decade.

- Red-hot Technology has produced 332 billionaires as software, internet, and e-commerce leaders monetize tech innovation.

- Consumer-focused industries like Fashion & Retail and Food & Beverage round out the top 5, catering to blossoming middle class markets.

Finance and technology remain the most lucrative sectors. But traditional manufacturing is still minting mega-fortunes as well, especially in Asia’s boom. This breakdown shows the diversity of billionaire sources.

8. The Sources of Immense Wealth

Behind every billionaire is a story of innovation, risk, and perseverance. The sources of their wealth often reflect the zeitgeist of their times and the industries they chose to champion.

Here’s a list of the top sources of wealth for our billionaires.

The Sources of Immense Wealth

The journey to billionaire status often commences with a single source of wealth, a venture, or an industry that lays the foundation for an empire. Here are the top 10 sources of wealth for the world’s billionaires:

- Real Estate (152 billionaires): Property investments and developments continue to be a robust avenue for wealth accumulation.

- Investments (92 billionaires): Strategic investments across various sectors have paved the way for many to the billionaire club.

- Diversified (91 billionaires): Having a diverse portfolio across multiple industries often equates to substantial wealth.

- Pharmaceuticals (85 billionaires): The health sector, especially pharmaceuticals, has been a goldmine for many.

- Software (63 billionaires): The tech boom has led to a surge in wealth for those involved in software development and services.

- Hedge Funds (41 billionaires): Managing and investing significant pools of capital can result in immense returns.

- Private Equity (40 billionaires): Like hedge funds, private equity offers lucrative opportunities for those with the acumen to spot them.

- Chemicals (39 billionaires) & Retail (39 billionaires): Both industries, while distinct, have produced a significant number of billionaires, showcasing their potential.

- Manufacturing (35 billionaires): The backbone of many economies, manufacturing continues to be a consistent source of wealth.

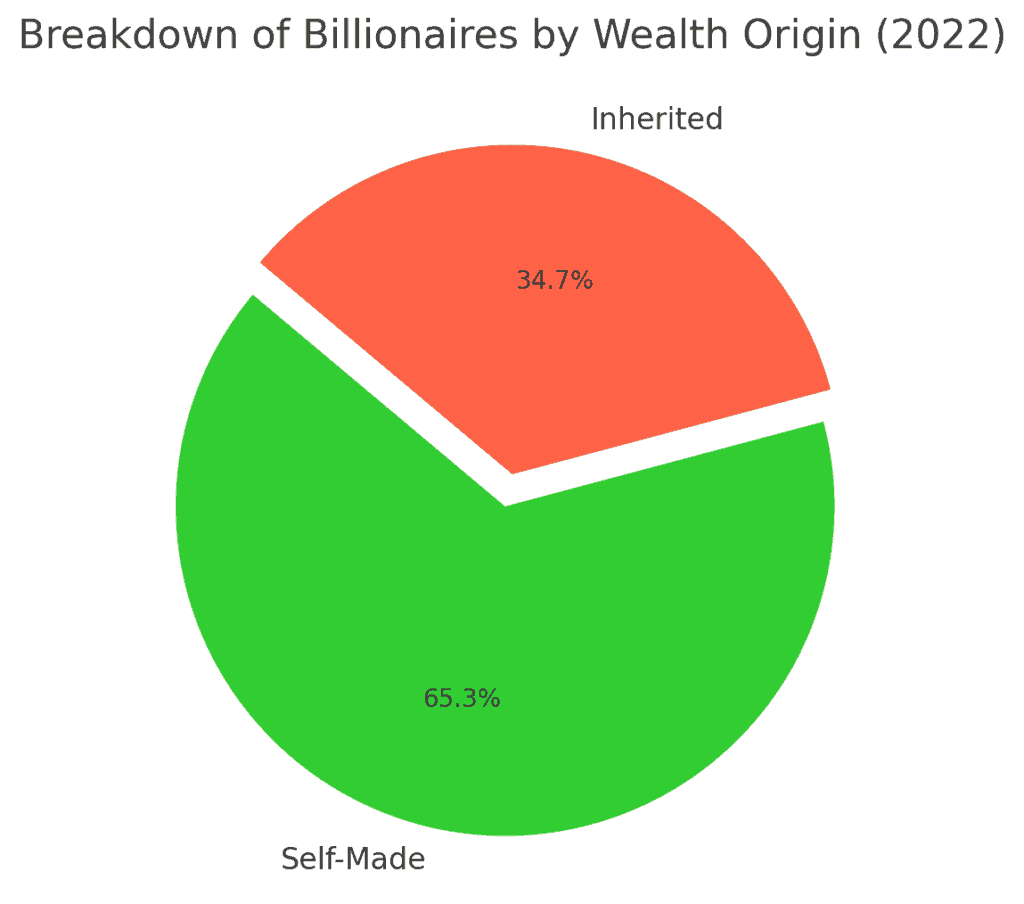

9. Inherited vs. Self-Made Billionaires

There is a common belief that billionaires predominantly inherit their wealth. But the data reveals otherwise:

Pie chart showing 1,741 self-made billionaire (65%) vs 927 inherited their wealth (35%)

- Nearly two-thirds of billionaires are self-made, building business empires that created their mega-fortunes. This route is exemplified by famed entrepreneurs like Elon Musk and Jeff Bezos.

- 578 billionaires inherited from family (22%), including prominent heirs like L’Oreal’s Francoise Bettencourt Meyers.

- And 349 billionaires inherited through spouses or divorce (13%), which can provide instant billionaire status overnight.

So while advantages of birth and connections matter, the majority of billionaires achieved their elite wealth through business prowess. This data challenges the notion that billionaires are just trust fund babies.

Key Takeaways

This deep dive into the patterns within the global billionaire class leads to some key conclusions:

- Billionaire numbers are rising rapidly (over 5x increase since 2001), fueling concerns over wealth concentration.

- The majority of billionaires are self-made and clustered in the $1B-$5B range, rather than the ultra-elite deca-billionaire bracket.

- Traditional hubs like the US, Western Europe, and Northeast Asia dominate the geographic breakdown, but other regions are rising.

- Finance, technology, manufacturing, retail/fashion, and food & beverage are the top billionaire-minting sectors, demonstrating diverse sources of mega-wealth creation.

While billionaires represent the pinnacle of economic success, this data highlights they are a heterogeneous group with nuanced trends across gender, age, geography, industry, and background. The continued growth of billionaires globally ensures they will remain a subject of intense fascination and scrutiny in the decades ahead.

Final Thoughts

The journey through the world of billionaires is a testament to human ingenuity, ambition, and the relentless pursuit of success. Whether they hail from the bustling streets of Silicon Valley or the fashion capitals of Europe, these individuals have left an indelible mark on the global economy.

In studying their trajectories, one thing becomes clear: while wealth is a measure of financial success, the true value lies in the impact these magnets have on the world, the industries they revolutionize, and the legacies they leave behind.

Navigating the world of billionaires is akin to traversing a landscape of ambition, innovation, and sheer determination. From tech moguls to real estate magnates, each individual has carved a niche, leaving an indelible mark on the global economy. Their stories inspire, their ventures transform industries, and their legacies serve as blueprints for future generations of entrepreneurs.

In a world as dynamic and ever-evolving as ours, one thing remains constant: the relentless human spirit that drives us to reach for the stars, to innovate, and to create. The billionaire landscape is not just a testament to wealth but to the boundless possibilities that await those who dare to dream.

Conclusion – a few interesting questions behind self-made billionaires

We would all like to know –

Q. What is the combined wealth of all the entries on Forbes World’s Billionaire List?

A. The total wealth owned by all the billionaires on this list is approximately

$12,221.8 billion, or $12.22 trillion.

This staggering amount underscores the immense concentration of wealth among the world’s richest individuals.

Here are some additional trivial questions and their answers based on the dataset:

Question 1: How many unique countries are represented in the list?

A. There are 77 unique countries represented by the billionaires in the dataset.

Question 2: Who is the youngest billionaire on the list, and how much are they worth?

A. The youngest billionaire is Clemente Del Vecchio, aged 18, with a net worth of $3.5 billion.

Question 3: Which industry has the fewest billionaires?

A. The “Gambling & Casinos” industry has the fewest billionaires, with only 25 individuals on the list.

Question 4: How many billionaires have a net worth greater than $100 billion?

A. There are 6 billionaires with a net worth exceeding $100 billion.

Question 5: What’s the average age of billionaires in the technology sector?

A. The average age of billionaires in the technology sector is approximately 57.4 years.