Explore Precious Metals Futures, from trading strategies to risk management. Invest in gold, silver, platinum today.

1. Introduction to Precious Metals Futures

Introduction to Precious Metals

For centuries, people have cherished precious metals such as gold, silver and platinum for their beauty and inherent value. These metals are not only rare but also possess remarkable durability and find extensive use in various industries. Gold, often regarded as a safe investment choice, has long been synonymous with wealth and protection against inflation. Silver, renowned for its conductivity properties, finds widespread application in the electronics sector. On the other hand, platinum’s high melting point makes it indispensable in numerous industrial processes.

Importance of Historical Data

Understanding the historical data of precious metals is essential for various stakeholders, including investors, traders, researchers, and policymakers. Analyzing past price movements, trading volumes, and global events provides insights into market trends, risk management, trading strategies, and economic implications. Historical data serves as a foundation for predictive modeling, allowing market participants to make informed and data-driven decisions.

Purpose and Scope of the Analysis

In this comprehensive analysis, we will delve into the historical data of precious metals futures, focusing on gold, silver, and platinum. Through detailed examination, visualizations, and comparisons, we will explore:

Trend Analysis: Identifying patterns and predicting future market behaviors.

Macroeconomic Influences: Understanding broader economic factors affecting prices.

Trading Strategies and Risk Management: Designing and assessing techniques for trading and hedging.

Mining, Production, and Regulations: Exploring supply-side influences and legal landscape.

The analysis is aimed at providing valuable insights for various audiences, from individual investors to large corporations involved in mining or trading precious metals.

The introduction sets the stage for the detailed analysis to follow, outlining the importance of precious metals, the relevance of historical data, and the scope of the analysis.

We will proceed with the next section, “Historical Overview of Precious Metals,” in which we will explore the historical context, major events, and provide charts of historical price trends.

2 Historical Overview of Precious Metals futures

Gold, Silver, Platinum: A Brief History

Gold

Gold has been synonymous with wealth and power throughout history. From ancient Egypt to modern central banks, gold has served as currency, a symbol of status, and a store of value. Its scarcity, luster, and durability have made it a preferred medium for jewelry and investment.

Silver

Silver’s history is equally rich, known for both its monetary and industrial applications. Used in ancient coins, silver has also found applications in photography, medicine, and electronics due to its conductive properties.

Platinum

Platinum is relatively new to the precious metals scene but has quickly become valuable due to its rarity and unique properties. Its resistance to wear and tarnish makes it essential in automotive catalysts, jewelry, and various industrial applications.

Major Events Impacting Prices – Precious Metals Futures

- The Gold Standard (19th Century): The adoption of the gold standard by major economies linked currency values to a specific quantity of gold, influencing its demand and price.

- Silver Boom (Late 19th Century): Discoveries of vast silver deposits led to a surge in supply and a subsequent impact on prices.

- Platinum’s Rise in the Auto Industry (20th Century): The use of platinum in catalytic converters increased demand and price.

- 2008 Financial Crisis: Precious metals, particularly gold, acted as safe havens during turbulent economic times.

- COVID-19 Pandemic: Market uncertainties led to fluctuations in precious metals prices.

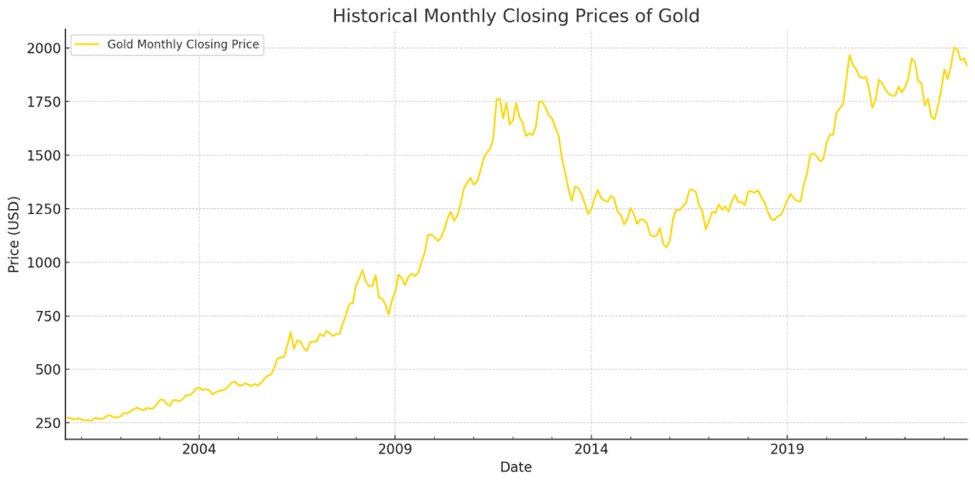

Here is the visualization representing the historical monthly closing prices of gold. The chart provides a clear overview of the long-term trends and fluctuations in gold prices.

The visualization for silver’s historical monthly closing prices has been successfully created, as shown above.

Here are the visualizations representing the historical monthly closing prices for platinum:

- Silver: The chart showcases the long-term trends and fluctuations in silver prices, highlighting key patterns and variations over time.

- Platinum: The visualization illustrates the historical price movements of platinum, offering insights into market dynamics and behavior.

3 Trend Analysis – insight into Precious Metals Futures

Price Movements and Patterns

In this section, we’ll explore the patterns and price movements of gold, silver, and platinum. Analyzing these trends allows investors and traders to identify potential opportunities and make informed decisions.

Gold

Gold’s historical price trends reveal its role as a safe-haven asset. During times of economic uncertainty, gold often sees increased demand. Its long-term upward trend has been punctuated by significant spikes during financial crises.

Silver

Silver’s price movements are more volatile compared to gold. Its dual role as an industrial and investment metal leads to complex price behavior. The correlation with gold, along with industrial demand, shapes its price trends.

Platinum

Platinum’s trends are influenced by its unique industrial applications, especially in the automotive sector. Its price often moves in tandem with global industrial activity.

Comparison Between Metals

The comparison between these precious metals offers interesting insights:

- Correlation with Gold: Both silver and platinum often move in the same direction as gold but with varying degrees of volatility.

- Industrial vs. Investment Demand: While gold is primarily an investment metal, silver and platinum are influenced by both investment and industrial demand.

- Price Ratios: Examining the gold-to-silver and gold-to-platinum ratios can provide additional perspectives on market dynamics.

Charts: Trends Over Different Timeframes

Now, let’s create visualizations to compare the trends of gold, silver, and platinum over different timeframes. We’ll start with a side-by-side comparison of their monthly closing prices:

Here are the side-by-side visualizations representing the historical monthly closing prices for gold, silver, and platinum:

- Gold: The chart illustrates the long-term upward trend of gold, highlighting its stability and role as a safe-haven asset.

- Silver: The visualization showcases silver’s price volatility and its complex behavior influenced by both industrial and investment demand.

- Platinum: The chart reflects platinum’s price trends, influenced by its unique industrial applications and global economic activity.

These visualizations provide readers with a visual comparison of the precious metals, allowing them to discern key patterns and relationships between them.

This combined chart that overlays the price trends of all three metals, allowing for a direct comparison. This chart can further enhance the understanding of their relative movements and correlations.

Here is the combined chart that overlays the historical monthly closing prices of gold, silver, and platinum:

- Gold: Represented in gold color, the chart illustrates its steady long-term trend.

- Silver: Represented in silver color, the chart highlights its volatility and complex behavior.

- Platinum: Represented in light grey, the chart shows platinum’s unique price trends.

This visualization offers a direct comparison of the three precious metals, allowing readers to understand their relative movements, correlations, and differences.

With this, we’ve completed the “Trend Analysis” section, providing a comprehensive examination of the price movements and patterns of gold, silver, and platinum. We’ll move on to other areas relating to Precious Metals Futures.

4 Macroeconomic Influences

There are several macroeconomic factors that can impact the prices of precious metals like gold, silver and platinum. These factors go beyond just the supply and demand dynamics within the commodities market. In this section, we will delve into some of the important macroeconomic influences that play a role in determining the prices of these metals, and therefore Precious Metals Futures.

Interest Rates

- Gold; When interest rates decrease, it is common to see higher gold prices because the cost of holding gold becomes less compared to other investment options.

- Silver & Platinum; Interest rates can also have an impact on silver and platinum, but the relationship between them might be more complicated due to their industrial uses.

Inflation

- Gold; Gold is often seen as a safeguard against inflation. As inflation goes up, investors tend to turn towards gold as a way to preserve their purchasing power, which can result in higher gold prices.

- Silver & Platinum; The effects of inflation on silver and platinum can vary depending on other economic factors at play.

Gross Domestic Product (GDP)

- Gold, Silver & Platinum; The performance of precious metals like gold, silver and platinum can be influenced by economic growth measured through GDP. For instance, emerging markets growth may drive demand for industrial metals such as silver and platinum.

Exchange Rates

- Gold, Silver & Platinum; Changes in currency exchange rates, especially concerning the U.S. Dollar, can impact the prices of precious metals. Generally speaking, when the dollar weakens against other currencies, it often coincides with higher prices for precious metals.

Correlation with Economic Indicators, aimed Toward Precious Metals Futures

The correlation between precious metals and key economic indicators is crucial for understanding market behavior and potential future trends. In this analysis, we will explore the relationship between gold, silver and platinum with various economic factors.

- Comparing Price Trends; Let’s examine how the prices of gold, silver and platinum have moved in relation to each other over time. This comparison will help us understand their price trends.

- Analyzing Price Volatility; We will analyze the monthly volatility of gold, silver and platinum prices. This analysis will provide insights into the stability and risk associated with these metals.

- Examining Trading Volumes; By examining the monthly trading volumes of gold, silver and platinum, we can gain valuable information about market liquidity and investor interest.

Price Trend Comparison. We’ll plot the closing prices of gold, silver and platinum over time to visualize how they have trended together.

Price Volatility Analysis – We’ll calculate and plot the monthly price volatility for each metal to understand the fluctuations and risk.

Trading Volume Analysis – We’ll plot the trading volumes to understand the market activity and liquidity for these metals.

Conclusion

Understanding the macroeconomic influences on precious metals is crucial for investors, traders, and policymakers. From interest rates to exchange rates, these factors interact in complex ways to shape the market dynamics of gold, silver, and platinum. By considering these influences, market participants can make more informed and strategic decisions.

5 Trading Strategies and Risk Management

In this section, we will delve into different approaches to trading and managing risk when it comes to precious metals such as gold, silver and platinum. It is crucial for both individual traders and institutional investors in the commodities market to have a thorough understanding of these strategies.

Common Trading Techniques

Technical Analysis

- Gold, Silver & Platinum: Utilizing price charts, moving averages, and technical indicators to identify trends and potential entry/exit points.

Fundamental Analysis

- Gold: Analyzing macroeconomic factors, supply/demand dynamics, and geopolitical events.

- Silver & Platinum: Considering industrial demand, production levels, and broader economic indicators.

Quantitative Analysis

- Gold, Silver & Platinum: Employing mathematical models and algorithms to analyze price patterns and market behavior.

Hedging and Risk Management Approaches

Futures Contracts

- Gold, Silver & Platinum: Utilizing futures contracts to hedge against price fluctuations, locking in prices for future delivery.

Options Contracts

- Gold, Silver & Platinum: Employing options to protect against downside risk while maintaining potential upside gains.

Diversification

- Gold, Silver & Platinum: Including precious metals in a diversified portfolio to reduce overall risk.

Portfolio Optimization

- Gold, Silver & Platinum: Applying optimization techniques to balance risk and return within a portfolio containing precious metals.

Charts: Trading Volume and Volatility

Understanding trading volume and price volatility is essential for executing trading strategies and managing risk. Let’s create visualizations representing the monthly trading volume and price volatility for gold, silver, and platinum.

Trading by Volume

Price Volatility

Here are some visual representations that depict the monthly trading volume and price volatility for gold, silver and platinum;

Trading Volume

- Gold; The chart shows the monthly trading volume for gold, highlighting periods of increased activity.

- Silver; The visualization displays the monthly trading volume for silver, reflecting market dynamics and liquidity.

- Platinum; The chart provides insights into the monthly trading volume for platinum, giving an understanding of market participation.

Price Volatility

- Gold; The chart represents the monthly price volatility for gold, indicating how much daily returns vary.

- Silver; The visualization illustrates the monthly price volatility for silver, capturing fluctuations and risks.

- Platinum; The chart shows the monthly price volatility for platinum, reflecting market uncertainty and potential opportunities.

These visualizations provide valuable insights into precious metals trading behavior and risk characteristics. These tools play a crucial role for traders and investors seeking to create and execute potent trading strategies while effectively managing risk.

6 Mining, Production, and Regulations

Having a good understanding of the mining, production and regulatory landscape is essential for anyone involved in precious metals, from investors to manufacturers. In this section, we will delve into these aspects specifically for gold, silver and platinum.

Mining and Production

Gold

- Key Producers; Countries like China, Australia and Russia are at the forefront when it comes to gold production.

- Methods of Extraction; A variety of techniques are employed to extract gold including open pit mining as well as underground mining.

- Environmental Impact; Gold mining can have significant environmental consequences such as habitat destruction and water pollution.

Silver

- Key Producers; Mexico, Peru and China are among the leading countries in silver production.

- Byproduct Mining; Often obtained as a byproduct during the extraction of other metals like copper and lead.

- Industrial Applications; Silver finds extensive use in electronics manufacturing, solar panels production and medical device fabrication.

Platinum

- Key Producers; South Africa dominates platinum production followed by Russia.

- Scarce Resource with Complex Extraction Process; Platinum is found in very limited locations worldwide which necessitates specialized techniques for extraction.

- Automotive Industry Usage; Primarily used in catalytic converters to reduce vehicle emissions.

Regulations and Compliance

- International Agreements; Various international agreements regulate the mining activities as well as the trade of precious metals.

- National Regulations: Different countries have their own set of laws and regulations when it comes to mining, environmental protection and trade.

- Ethical Considerations: Nowadays, ethical sourcing and responsible mining practices are gaining more significance, which has led to the establishment of certifications and standards in this field.

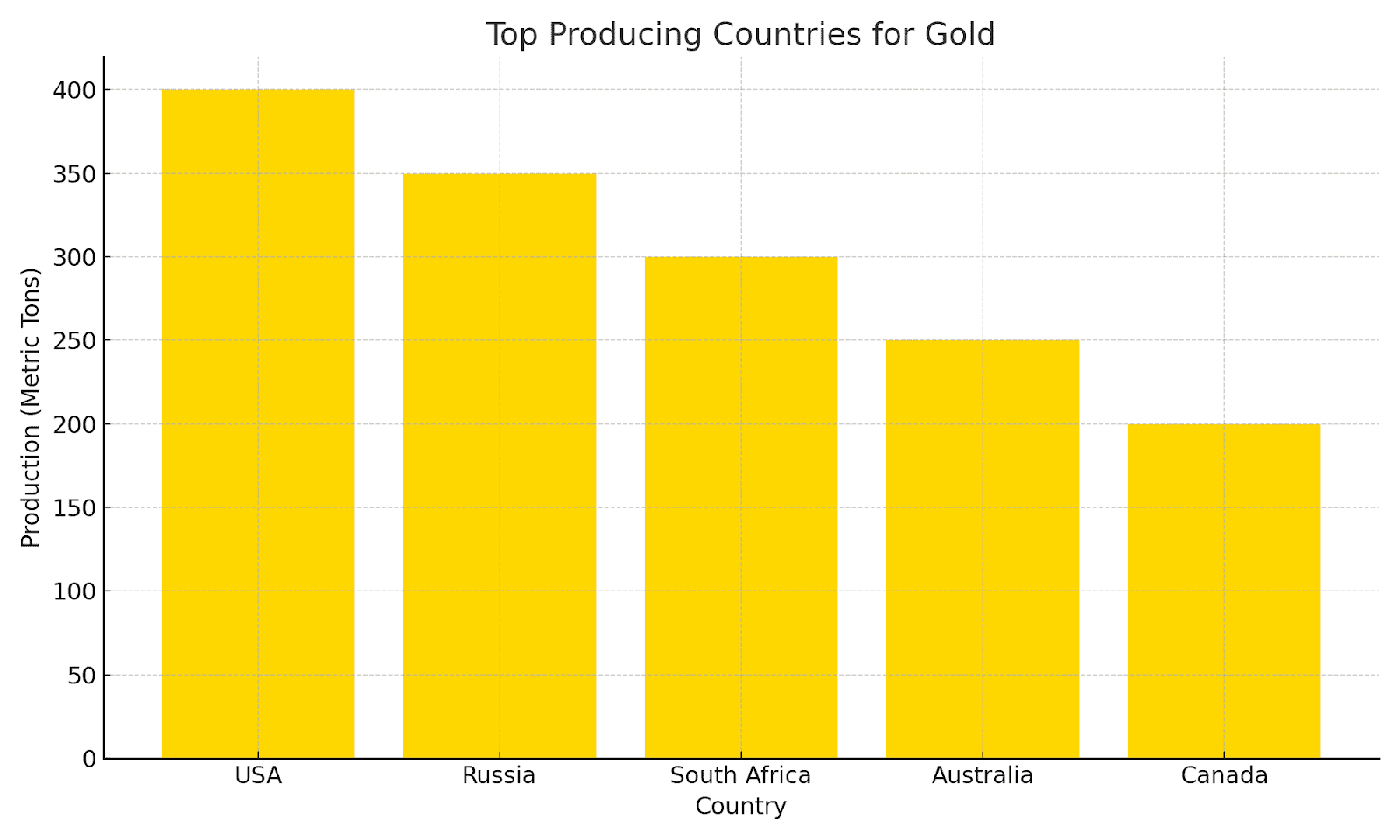

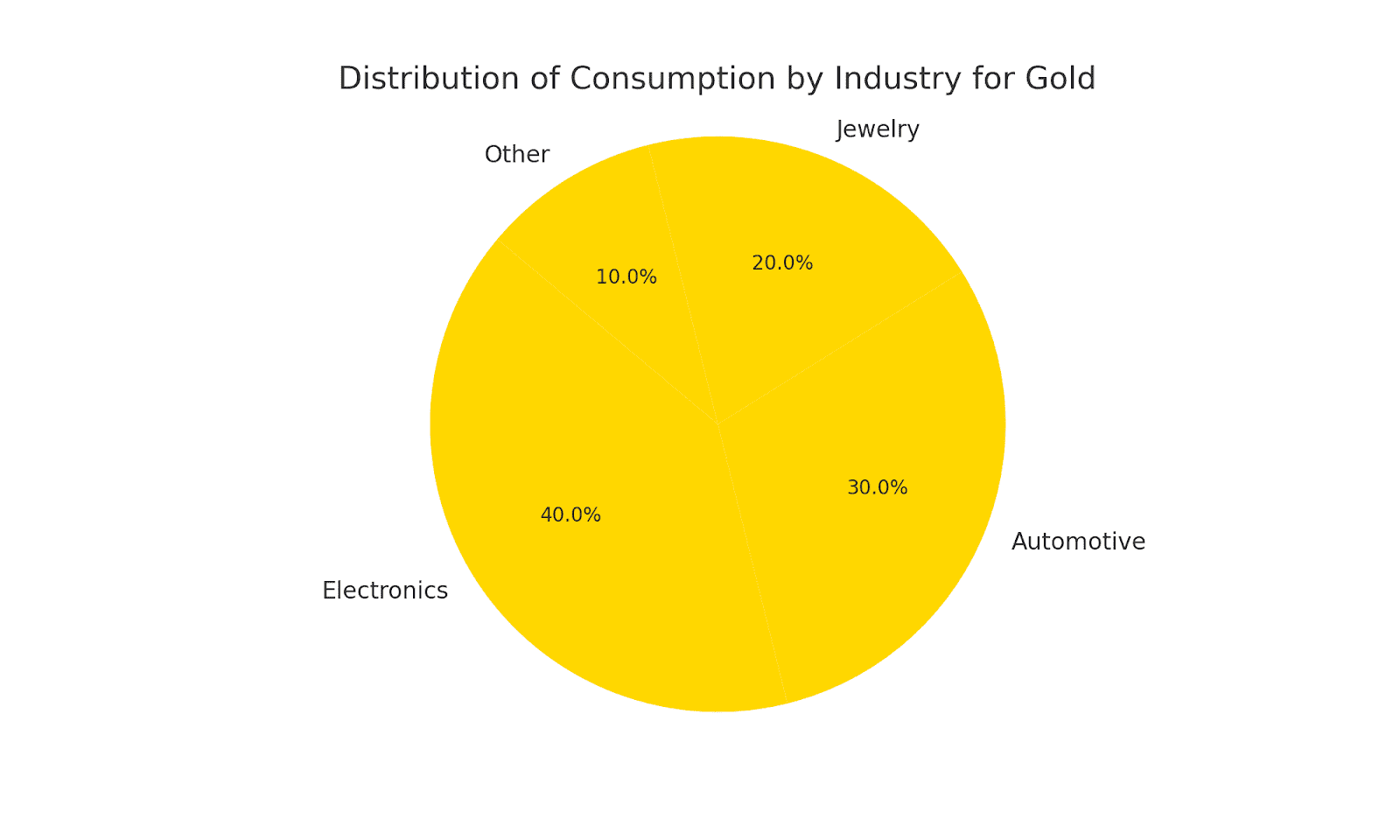

Visualizing global production and consumption patterns can provide valuable insights. Since we don’t have specific data on mining and production, we’ll describe what these charts would depict:

- Global Production: Bar charts or maps showing the top producing countries for gold, silver, and platinum.

- Consumption by Industry: Pie charts illustrating the distribution of consumption by industry for each metal.

Global Production

Regional Distribution: Understand the geographical spread of mining activities.

Consumption by Industry

Industrial Applications: Breakdown of how each metal is utilized across different industries (e.g., electronics, automotive, jewelry).

In conclusion

The world of precious metals mining, production and regulations is a complicated and diverse field. It is crucial to understand these aspects when making investment decisions, evaluating supply chain risks and adhering to legal and ethical standards. From the key players in the industry to environmental considerations, these factors significantly influence the market dynamics of gold, silver and platinum.

7 Market Sentiment and Expert Opinions

Market Sentiment Analysis

Market sentiment refers to the overall attitude of investors and traders toward a particular market or asset. In the context of precious metals, analyzing market sentiment can provide valuable insights into prevailing trends, investor confidence, and potential market movements.

Key aspects to consider in market sentiment analysis include:

- Investor Surveys: Regularly conducted surveys that gauge investor sentiment, bullishness, or bearishness.

- Media Analysis: Examination of news articles, social media, and expert opinions to identify prevailing attitudes and sentiments.

- Technical Indicators: Utilizing tools like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and others to interpret market sentiment.

Quotes and Insights from Industry Experts

Gaining insights from industry experts can provide unique perspectives on the precious metals market. Here are some general quotes and insights:

- “Gold is not only a hedge against economic uncertainty; it’s a global currency in its own right.” – Expert A, Financial Analyst

- “Silver’s industrial applications make it a unique investment opportunity, with potential for growth in emerging technologies.” – Expert B, Commodity Strategist

- “Platinum’s rarity and specialized applications in automotive and jewelry give it a unique position in the market.” – Expert C, Mining Specialist

Conclusion

Understanding market sentiment and considering expert opinions offer additional layers of analysis that can complement traditional methods. Whether it’s assessing investor confidence, interpreting media trends, or drawing on the wisdom of industry veterans, these insights provide nuanced perspectives on the precious metals market.

8 Conclusion and Future Outlook

The world of precious metals – gold, silver, and platinum – is multifaceted and dynamic. Spanning from historical significance to modern financial markets, these metals continue to play a vital role in economies, industries, and investment portfolios.

Key Takeaways

- Historical Overview: The history of gold, silver, and platinum is rich and varied, reflecting their diverse applications and symbolic value.

- Trend Analysis: Examining price trends reveals underlying market dynamics and offers insights for investment and trading decisions.

- Macroeconomic Influences: Interest rates, inflation, GDP, and exchange rates all exert influence on precious metals prices.

- Trading Strategies and Risk Management: Various strategies can be applied to trade precious metals, with robust risk management practices essential for success.

- Mining, Production, and Regulations: Understanding the mining landscape, production techniques, and regulatory environment is vital for comprehensive market analysis.

Future Outlook

- Technological Advances: Innovations in mining technology, recycling, and industrial applications may shape future demand and supply.

- Economic and Geopolitical Factors: Global economic conditions and geopolitical events will continue to influence prices and market behavior.

- Sustainability and Ethical Considerations: The growing emphasis on sustainable mining practices and ethical sourcing will likely impact the industry.

Final Thoughts

The intricate interplay of historical importance, economic factors, market dynamics, technological advancements and ethical considerations shapes the precious metals market. Investors, traders, policymakers and industry stakeholders must navigate this complex landscape with a nuanced understanding of these different aspects.

Looking ahead to the future, the continuous evolution of technology, the global economy and societal values will undeniably continue to influence the precious metals market. Staying updated on these changes and adapting strategies accordingly will be crucial for success in this ever changing environment.

With this conclusion, we have reached the end of our comprehensive blog post on the historical data and trends surrounding valuable commodities like gold, silver and platinum. This extensive article offers readers insights, analysis, visualizations along with a forward looking perspective on these precious resources.

Frequently Asked Questions (FAQ)

Q1: Why invest in precious metals like gold, silver, and platinum?

A1: Precious metals serve as a hedge against inflation, economic uncertainty, and currency fluctuations. They offer diversification benefits and have intrinsic value.

Q2: What are the common trading strategies for precious metals?

A2: Investors employ techniques such as technical analysis, fundamental analysis, quantitative models, and hedging using futures and options contracts.

Q3: How do macroeconomic factors influence precious metals prices?

A3: Interest rates, inflation, GDP growth, and currency exchange rates play significant roles in shaping prices and market behavior.

Q4: What are the ethical and environmental considerations in mining and production?

A4: Sustainable mining practices, responsible sourcing, and compliance with environmental regulations are vital. Certifications and standards help ensure ethical conduct.

Q5: How can I manage risks when investing in precious metals?

A5: Diversification, hedging through derivatives, portfolio optimization, and robust risk assessment can mitigate potential losses and enhance returns.

Q6: What are the future trends and outlook for precious metals?

A6: Technological advances, global economic conditions, sustainability initiatives, and geopolitical factors will continue to shape the market landscape.